WHAT IS

FORM 1040-NR ?

Table of Contents :

What is Form 1040-NR ?

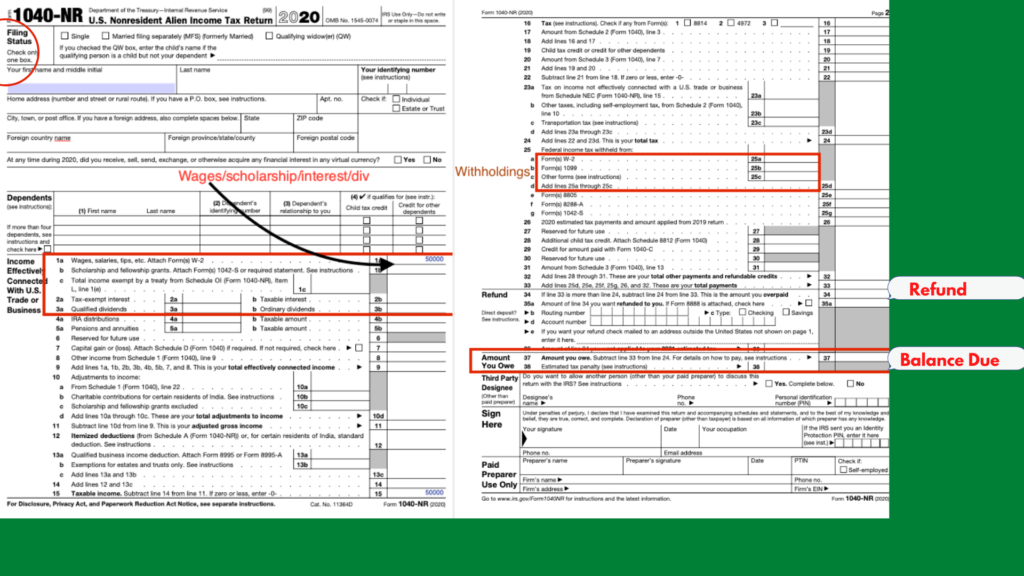

Non-resident Aliens or (NRA) must use Form 1040-NR (Non-Resident) to report their US source income to the IRS. An alien is a person who is not a U.S. citizen/National. A nonresident alien is an alien who has not passed the Green card test(Lawful Permanent Resident) or the Substantial presence test. Remember, only US Residents, Citizens must report their Income on Form 1040.

Even though the Form 1040-NR was recently updated to look similar to the Form 1040, still there are many differences between the 2 forms. Many Credits, Deductions, Filing Status still aren’t available to Non-Residents.

Prior to 2020, there was a simpler version of Form 1040-NR, known as Form 1040NR-EZ. This form has been made redundant by the IRS. Hence, going forward only Form 1040-NR must be used by Non-Residents.

Who should File Form 1040-NR?

Usually, Non-residents(who don’t meet the Green Card or the substantial presence Test) with US source Income must file Form 1040NR.

If you fall in any of the below Categories, must file Form 1040NR:

- A Non-resident alien individual engaged or considered to be engaged in a trade or business in the United States during the year.(Student/Trainee)

- A non-resident alien individual who is not engaged in a trade or business in the United States and has U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.(Mostly passive income)

- A Resident or domestic fiduciary, or other person, charged with the care of the person or property of a nonresident individual may be required to file an income tax return for that individual and pay the tax.

- If you are an International student/trainee/teacher on F/J/M/Q Visa, you must file Form 1040-NR to report income from Wages, tips, scholarship and fellowship grants, dividends.

- Self-employment income more than $400 (NRA’s are not subject to Self-employment tax)

Usually Short term US Assignees (Inpats), students must file their Tax Returns if they have any withholdings from their Employment Income in the US. In most cases, income is less than $30K, because well, they are Students and short-term assignees. Graduate students from India get standard deduction of $12,XXX as an exception, even though all Non-Residents by default are only eligible for Itemized Deduction. The United States has tax treaties with several countries on this Planet and a Tax Expert should be able to figure out the Benefit, if any, that is available. Most Non-Residents who have returned back to their home country don’t feel the need to file, in fact most of them are just leaving the money on the table!

Another case where you should file your Tax return as a Non-Resident would be when you own a US Rental Property. By choosing an election and reporting income as effectively connected (discussed later), income is taxed at the same marginal rate like US residents instead of the flat 30% with no deductions for FDAP income.

Who is a Non-Resident Alien?

Any Individual who doesn’t meet the Substantial Presence Test or the Green Card Test for the year will be considered as a Non-Resident Alien.

To meet the Substantial Presence Test, one must have at least 31 days in the US in the current year and meet the 183 days test that includes the current year and the previous 2 years before that based on a Formula.

- All the days in the Current Year …….

- ⅓ of the Days you were Present in the previous tax year …….

- ⅙ of the Days you were Present in the previous to previous Tax Year……

Example: You were physically present in the U.S. on 90 days in each of the years 2019, 2020, and 2021. To determine if you meet the substantial presence test for 2021, count the full 90 days of presence in 2021, 30 days in 2020 (1/3 of 90), and 15 days in 2019(1/6 of 90). Since the total for the 3-year period is 135 days, you are not considered a resident under the substantial presence test for 2021.

Alternatively, if you pass the Green Card Test–if at any point, you were considered as a lawful permanent resident of the United States during the tax year. If you were issued the “Green Card” by the US Citizen and Immigration Services (USCIS). If that Green Card isn’t abandoned, rescinded, or revoked by USCIS through a judicial process, you will maintain a resident status and pay taxes on World-Wide Income.

Fun Fact: Non-resident aliens are not eligible for the Stimulus Payments under the Cares Act. If you have received it by mistake, you should be returning it.

What Income is Taxable for a Non-Resident in the US on Form 1040NR?

There are 2 categories that decide how income for Non-Residents are Taxed in the US on Form 1040-NR.

Effectively Connected Income (ECI)

VS

Fixed, Determinable, Annual & Periodical (FDAP)

The effectively connected Income is taxed at graduated rates, very much like US residents in contrast to FDAP income(dividends, interest, rents, royalties, services) which is taxed at a flat 30% or lower if there is a treaty.

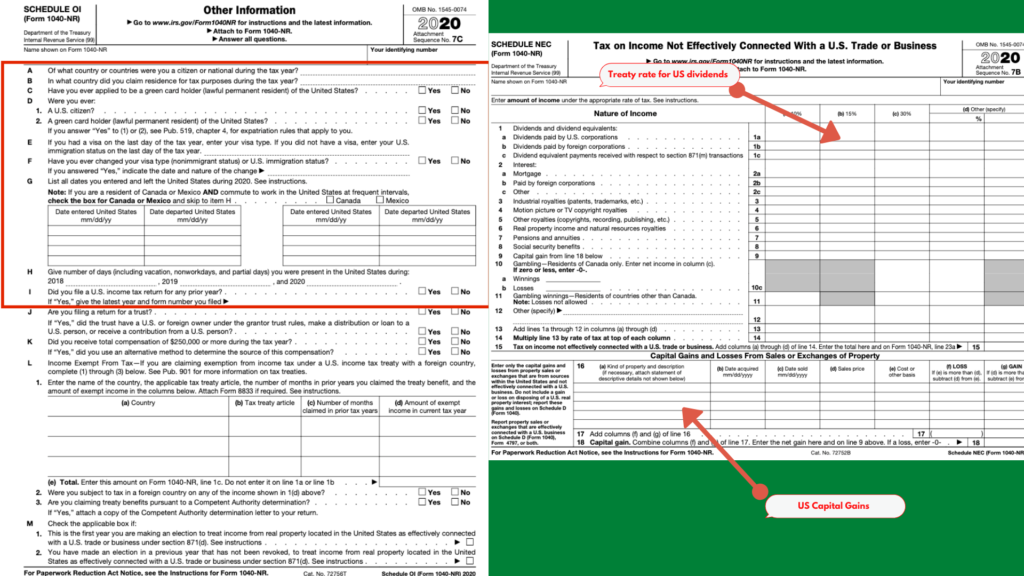

For Non-Residents interest income from the US Bank is non-taxable under Internal Revenue Subsections 871(h) & (I). For Dividend income from a US company which is reported on Form 1099, will be taxed at 30% unless a treaty exists between the US & the home country. This is reported on Schedule NEC (Not effectively connected).

Capital gains through US brokers for US Securities are not Taxable for Non-residents.

Exception:However, the important point here is your VISA Status in the United States.

Are you Non-Resident because you don’t meet the substantial presence test or are you a Non-resident because you are considered an exempt individual because of your visa status in the United States (visa A, G, F, J, M, Q).

A flat tax of 30 percent is imposed on U.S. source capital gains in the hands of non-resident alien individuals physically present in the United States for 183 days or more during the taxable year. This 183-day rule bears no relation to the 183-day rule under the substantial presence test of IRC section 7701(b)(3).

Many Foreign students/teachers and employees of Foreign government fall in this category. For them, capital gains are considered not effectively connected with the conduct of a United States trade or business, hence taxed at flat 30% and reported on Schedule NEC and not on Schedule D.

When and Where to File Form 1040NR?

Based on all that was discussed above, if you have Taxable US source Income, US employment Income, US rental or self-employment income, Dividends, and Capital Gains, you must file Form 1040NR, assuming you do not meet the Green Card or the Substantial Presence Test.

The filing due date is the same date as the US residents would file, which is the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year, this is generally April 15. As an exception, the due date for the 2020 Tax Year is May 17, 2021. The Non-Resident Tax Returns can be e-filed now in most cases. Check the link here on where to file your Form 1040NR.

Conclusion:

Although Form 1040NR happens to be easier and less detailed than Form 1040, the Tax treatment needs more detailed analysis with respect to source, visa, Treaty, country, and type. Commercial tax software is built more in favor of Resident Tax Returns. The same would apply to the local block accountants. If you are a student who has Income through OPT, a temporary tech worker, and a new Foreign National who hasn’t met the SPT test in the US, you must seek a Tax Professional who is familiar with Tax Returns for Foreign Nationals and International Students. At Cloud Expat Tax, we have plenty of experience in preparing Tax Returns for Foreign Nationals and American Expats. Schedule a Call with us today here.

Frequently asked Questions

- Ravi is a Student from India on F1 Visa who is currently undergoing OPT at Company X. His W2 shows an Income of $45,000 for 2021. Which Form does he need to file? Do students from India get any tax benefits?

Ans. You need to File form 1040NR to report your wage Income. There is no standard deduction for Non-residents on Form 1040-NR, except for students from India who get the standard deduction of $12, xxx. Since you are on an F1 Visa, Form 8843 also needs to be completed to maintain the exempt status of the Individual.

- Jennifer was an F-1 Student who recently moved on an H1 visa through her Employer on April 1, 2021. What Tax return should she File?

Ans. Foreign Nationals on immigrant visas like H1, will be treated as residents and must file Form 1040 and report their worldwide income to the IRS. If you have a foreign bank account, Congratulations! If you have more than $10k at any point, you must File FBAR, irrespective of whether you need to file your tax return or not. Since our taxpayer was on F-1 Visa till March 31st, will be Non-Resident till that period and the residency will start from April 1st, 2021. Jennifer will file a Dual-Status Tax Return. She will attach Form 1040-NR which will be labeled as a dual-status statement. On top of Form 1040, it will be mentioned as Dual-Status Tax Return. This type of return has to be paper-filed.

- Tim was a short-term assignee in the US for less than 4 months. Due to an error, he files Form 1040, instead of Form 1040-NR. What must he do then?

Ans. Tim must immediately file form 1040x to amend his Tax Return and File Form 1040-NR

- John is a Student studying at New York University. John has an F-1 visa and is from Bermuda. John has no Income for the 2021 Tax Year.

Ans. John doesn’t need to file Form 1040-NR if there is no reportable US source income. He needs to complete Form 8843 and submit it to the IRS by the due date though.

- Joe is a student from the UK studying at Virginia Tech University. Is he eligible to claim Tuition credit or deduction on his Form 1040NR?

Ans. Only US residents can claim American opportunity credit or lifetime tuition credit and deductions on their Tax Returns. Non-Residents are not eligible. At the most, they can claim a Student loan Interest deduction, if eligible.

DISCLAIMER: The above info should only be considered for the knowledge of US Tax and not Legal Advice. Every Taxpayer’s situation is unique, strongly advise you to consult a Tax Professional.