Filing Non-Resident

US TAX RETURN

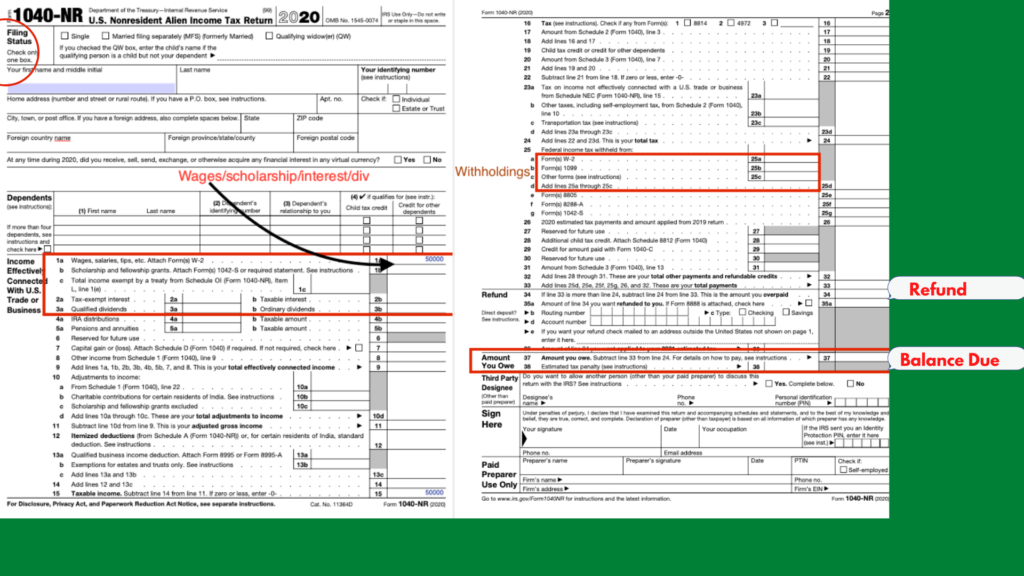

FORM 1040-NR

TABLE OF CONTENTS:

Which Form is used for FILING NON-RESIDENT US TAX RETURN? Who is a non-resident alien? WHO SHOULD FILE FORM 1040-NR?

Form 1040-NR is used for filing Non-Resident US tax returns. A Non-Resident Alien is a person who isn’t a US Citizen, is not a Green Card Holder, has not met the Substantial Presence Test (SPT) nor is a US National. A typical example would be a Foreign National coming to the US on an L1/B1/J1/F1 (/Inter-company/Foreign Business Visitor/Students/Exchange Visitor) on a very short term assignment (less than 183 days) and maintaining a Tax home in the Foreign Country. In the following section, we will discuss in more detail, regarding filing a Non-Resident US Tax Return on Form 1040NR.

According to the IRS, if you are an Individual

● Who is engaged in trade and business (9-5 work, US rentals) in the US, you must file the 1040-NR Tax return.

● If you are not engaged in any trade or business in the United States but have received an amount and the taxes on it are not covered by the withholding system.

● If you were a nonresident alien (student/teacher/trainee) present in the United States on an “F,” J,” M,” or “Q” visa for a short duration, you are considered engaged in a trade or business in the United States.

● If you have received Form W-2 from your US employer and you want to claim the taxes withheld as a refund, assuming your income is low, you can file your tax return.

Prior to 2018, before the changes in the tax laws made by the Tax Cut and the Jobs Act (TCJA), if an individual’s income was lesser than the personal Exemption ($4, XXX), there was no need to file the Tax return. Now, there isn’t any income threshold for a Non-resident at least. Residents can always take a standard deduction of $12, XXX on their return and stay tax-free. For Non-resident, might have to use the Tax Calculator to figure out if any liability is due before deciding on the filing of Non-resident US tax return Form 1040NR.

WHO IS AN EXEMPT INDIVIDUAL?

An exempt individual is a person who is exempt from the residency criteria of the Substantial Presence Test. This person is NOT exempt from US tax.

This individual must file Form 8843 and explain the basis to exclude the presence days in the US under SPT, as an exempt individual or due to a medical condition. Even if no tax return for the year is filed, this form must be filed by the exempt individual.

Failure to file this form, the individual will not be able to exempt his presence days in the US and will be subject to taxation like a US Tax Resident.

An exempt individual could be an International Student, Athlete, Teacher/Trainee under F, J, M, Q visa subject to certain conditions. Check out taxation for International students here.

If you do not file Non-Resident US Tax Return, when you are supposed to, you may end up endangering your visa/green card or entry to the US, if and when you ever decide to come back to the US.

WHAT'S A CLOSER CONNECTION?

If you do happen to meet the substantial presence test for the year, but do maintain a tax home abroad, you can claim a closer connection to your home country if:

● You had less than 183 days in the US for the year.

● Maintained Tax home in Foreign country.

● You establish that you had a closer connection to that foreign country than the US.

In this case, you must complete Form 8840 along with Form 1040NR. If you have applied for a Green Card or taken steps to get one, this exception of closer connection will not apply.

WHAT ARE DUAL-STATUS TAX RETURNS?

If you do have more than 183 days based on the SPT test, you will have to file a “Dual-Status” of a Part-year return. You will be taxed on your World-Wide income from the date you became a US resident for tax purposes. For the part of the year, you were Non-resident and a statement would be attached to your tax return.

Please do note that by taking elections, you can file a full-year return. The advantage of filing a full-year tax return is the benefit of taking the standard deduction of around $25, xxx on the tax return. However, a joint tax return has to be filed, i.e. along with your spouse. Yes, the United States is the only country that allows you to file a joint tax return. (Income of taxpayer and spouse are clubbed and taxed together).

The tax rates, credits, deductions all favor a Joint tax return.

LIMITATIONS OF FILING A JOINT TAX RETURN

If prior to coming to the United States, you had a lot of employment income, passive income, so may want to file a dual-status arrival return. You do not want your home country’s income to be taxed in the United States. (A dual-status or a Non-resident tax return is always “Married filing separately or single”. A joint return cannot be filed.

Assuming you are landing in the US in February or March, it may make sense to take elections and prepare a full-year resident tax return compared to coming to the United States in the month of September or October, where filing a dual-status return may make more sense.

Foreign Nationals Leaving the United States

As a Foreign National, who meets SPT, can also file a Dual-Status tax return when you are leaving the United States. You will be taxed as a resident till your date of departure from the US. A departure statement needs to be attached to your tax return. You must also maintain a Tax home abroad in the year of departure and you shouldn’t be a resident of the US in the following year. As a Dual Status Return Taxpayer, you cannot claim the standard deduction and will have to file the tax return as married filing separately or single.

If you do return to the US the following year, you cannot file a Dual Status return again. There is a US tax concept called the “no-lapse rule”. The intervening period between residency and non-residency will always be deemed as a period of residency. It assumes that you never left the US. Also, you will have to amend your prior-year tax return to full-year resident return.

What are State Taxes?

Along with federal taxes, there are state and local/city/county taxes to be paid. Every state/city/locality has a different set of rules regarding domicile and residency status once the taxpayer starts working in the state or the local city. A driver’s license, voter’s id, a home, workplace in the state may help establish residency in that state. States have the same filing due date as federal tax returns. If you are working in more than one state, separate filing will be needed. You may or may not claim a credit for the taxes paid from a non-resident state/locality to your resident state. Also, income that is exempt by treaty on your federal, may or may not be exempt in your state.

What type of income is taxed for a non-resident in the us?

Generally for Non-Resident, only US-sourced income is taxed on the Form 1040-NR return. Any employment income from activities “effectively connected’’ to the US will be taxed on your Form 1040-NR. If you haven’t received Form W-2 from your employer, using your foreign payslips, the amount needs to be converted and taxed in the US based on US “Workdays” . If you worked in the US for 2 weeks, can consider 10 work days out of the 20 work days for the month. Generally, 240 workdays are assumed for tax purposes. The Tax treaty between the US and the Foreign country will also determine if the income is exempt or taxed at a lower rate.

Using the Dependency Personal Services (DPS) – A tax treaty terminology, the taxpayer may be able to exempt some or none of the employment income if :

● Have spent less than 183 days in the US in the current tax year.

● Have employment income from a Foreign employer.

● The Foreign employer has not charged back that income to the US employer.

These are just a few guidelines to consider before taking a treaty benefit as the income threshold is different for every country. Also, the Tax period could be different as not every country has a calendar year Tax year like the US. Tax Treaties are very complex and the interpretations can be very confusing. A tax expert is highly recommended in this regard.

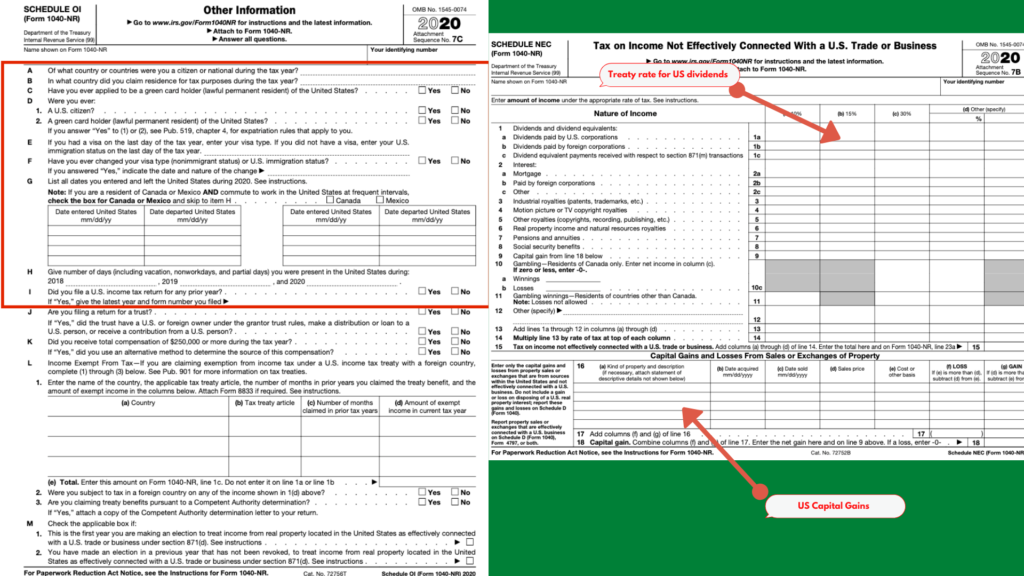

If you receive any investment income like dividends from the US corporation, they will be reported on your Form 1040-NR and also on page 4 Schedule NEC (Not effectively connected). NEC income is taxed as 30% unless there is a treaty with the foreign country. If you are a non-resident and have got capital gains from the sale of a US stock, no taxes are applicable, however, you must report on page 4 of your 1040-NR Tax return along with a footnote attached to the return. US bank interest is exempt from tax for a Non-Resident. A footnote too would suffice.

If you have US rental property and you are a Non-Resident. If there is a withholding of 30% on the Rental Income, there is no need to file a tax return. The withholding must be done by your Property Manager. Another option would be to take the 871(d) election. This election will allow you to deduct your expenses against your income and the income, if any, will be taxed at the graduated tax rate. This will be an effectively connected income.

How to apply for itin using form W-7?

The ITIN can be obtained by Filing form W-7, along with your tax return, proof of identity, and foreign documents to the address given below. (The tax return with ITIN application will be paper-filed)

Mail it to :

Internal Revenue Service Austin Service Center

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

Alternatively, you can also apply for an ITIN in-person using the services of an IRS-authorized Certified Acceptance Agent which will prevent you from having to mail your proof of identity and foreign status documents or you may make an appointment at a designated IRS Taxpayer Assistance Center (TAC) by calling 1-844-545-5640.

The passport is the only document (standalone) you can submit without bothering with the other foreign documents. A US visa would also be readily available, hence must also be attached to prove your “Foreign Status”.

It usually takes 6-8 weeks to process your ITIN Application. Once approved you will receive a letter after 6-8 weeks or a max of 10 weeks. If you do not receive notification within the timeframes above, you may call the IRS toll-free line at 1-800-829-1040 to check on the status of your application.

Final Words

Filing a tax return for a Non-Resident can be very challenging, especially in the year of arrival with treaties, elections coming into play. Also, the Taxpayer may or may not have a social security number required for filing. Based on the visa, may or may not be eligible for an SSN. In that case, will have to apply for ITIN (Individual Tax Identification Number). The important points for the taxpayer to remember for filing a Non-Resident return are the number of days spent in the US, the SSN or ITIN, any employment income/passive received, the states in which the work was performed, and finally if any intention to come back to the US at a later date.

If you have any questions regarding filing a Non-Resident Tax Return, feel free to get in touch with us.

DISCLAIMER: The above info should only be considered for the knowledge of US Tax. Every Taxpayer’s situation is unique, strongly advise you to consult a Tax Professional.