WHAT IS

FOREIGN HOUSING EXCLUSION OR DEDUCTION?

TABLE OF CONTENTS:

- Introduction

- Who is eligible to claim Foreign Housing Exclusion?

- How is Foreign Housing Exclusion Calculated?

- What are considered as Qualified Expenses for Foreign Housing Exclusion?

- Can both spouses claim Foreign Housing Exclusion?

- What is the difference between Foreign Housing Exclusion and Deduction?

- How is it Reported?

- Final Thoughts

INTRODUCTION

Living abroad in a Foreign Country is an expensive affair. Imagine, if you are an Expat living in London or Tokyo. A good portion of your monthly income would go in paying rent in these expensive Urban Metropolises. Strangely, the IRS understands this, hence you can claim Foreign Housing Exclusion or Deduction, in addition to the Foreign Earned Income Exclusion on Form 2555 for the Housing Expenses incurred abroad.

WHO IS ELIGIBLE TO CLAIM FOREIGN HOUSING EXCLUSION?

An US Expat or a Green Card Holder who is eligible to claim Foreign Earned Income Exclusion under the Bonafide Test or the Physical Presence Test and has a Tax Home abroad can claim it. The Taxpayer can only claim exclusion on Qualified Expenses which are below the Threshold limits. Exclusion is only applicable on the amounts incurred or paid with Employer-provided amounts. In other words, the foreign housing exclusion includes only amounts paid to you or paid or incurred on your behalf by your employer that are Taxable foreign earned income to you for the year (without regard to the foreign earned income exclusion).

HOW IS FOREIGN HOUSING EXCLUSION CALCULATED?

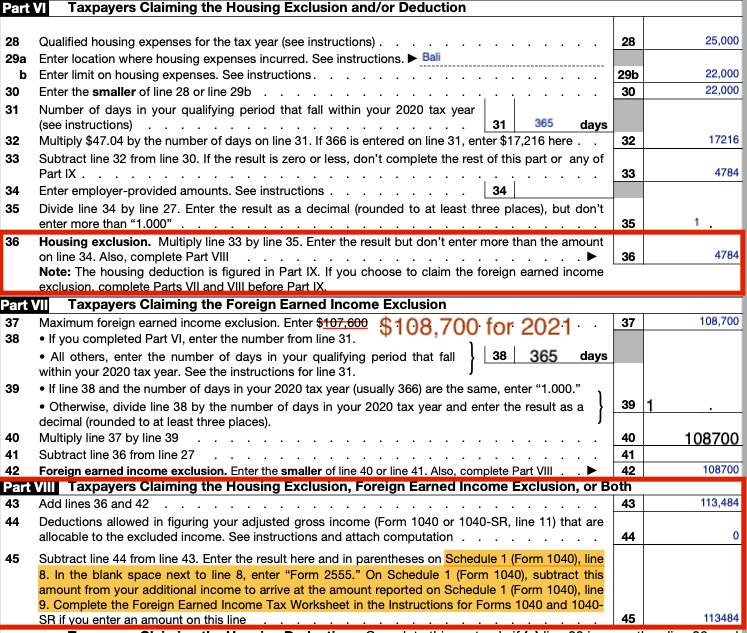

The Foreign Housing Exclusion has both a Minimum and Maximum Threshold limit. The base amount is about 16% of your Foreign Earned income Exclusion (FEIE) limit. The limit for FEIE for 2021 is $108,700. So the minimum Threshold is (16/100 *$108,700) = $17,392. To claim it, your minimum expenses must be over this amount. This threshold amount will get prorated for part year Taxpayer.

The Maximum upper limit is 30% of FEIE. For 2021, that limit would be (0.3*108,700) =$32,610.

This is the maximum available exclusion if you are not living in a high cost location as per the Table published by the IRS for several cities around the world. If you do live in a high cost location like London, you could claim ever higher exclusion or deduction based on the IRS Table.In short, it’s a calculation between the amount of Housing Expenses, limit set by your city, the base amount (16%) and the maximum limit(30%). These exclusions can be carried over to the next year, if there aren’t used entirely.

For 2021, its (30% of the $108,700) – 16% of $108,700) = ($32,610 – $17,392) = $15,218 is the Maximum housing exclusion, which will be an addition to the FEIE of $108,700. Like mentioned previously, if you live in a high cost location and have higher housing costs, you can claim even more.

WHAT ARE CONSIDERED AS QUALIFIED EXPENSES FOR FOREIGN HOUSING EXCLUSION?

Housing expenses should be reasonable and actually incurred in the period the Taxpayer was eligible to claim FEIE. Housing expenses do not include expenses that are lavish or extravagant under the circumstances, the cost of buying property, purchased furniture or accessories, and improvements and other expenses that increase the value or appreciably prolong the life of your property.

You should not include the value of the meals. Any accommodation given by your employer whose value is not reported on your Total Gross income must not be considered.

The following expenses which are reasonable will be considered:

- Rent

- Utilities (other than telephone charges)

- Real and personal property insurance

- Nonrefundable fees paid to obtain a lease,

- Rental of furniture and accessories,

- Residential parking and household repairs

Can both spouses claim Foreign HoUSING EXCLUSION?

If you and your spouse lived in the same foreign household and filed a joint return, you must figure your housing amounts jointly. If you file separate returns, only one spouse can claim the housing exclusion or deduction.

In figuring your housing amount jointly, either spouse (but not both) can claim the housing exclusion or housing deduction. However, if you and your spouse have different periods of residence or presence, and the one with the shorter period of residence or presence claims the exclusion or deduction, you can claim housing expenses only the expenses for that shorter period. The spouse claiming the exclusion or deduction can aggregate the housing expenses of both spouses, subject to the limit on housing expenses , and subtract his or her base housing amount.

If you and your spouse lived in separate foreign households, you each can claim qualified expenses for your own household only if:

- Your tax homes weren’t within a reasonable commuting distance of each other, and

- Each spouse’s household wasn’t within a reasonable commuting distance of the other spouse’s tax home.

Otherwise, only one spouse can claim his or her housing exclusion or deduction. This is true even if you and your spouse file separate returns.

WHAT IS THE DIFFERENCE BETWEEN FOREIGN HOUSING EXCLUSION AND DEDUCTION?

Foreign Housing exclusion is claimed by employed Expats. Self-employed individuals can claim Deduction on their Form 2555. As discussed earlier, exclusion is only applicable if the employer pays for the housing for the expat which is included as Gross Income for the Taxpayer.

For self-employed Individuals, housing deduction is applicable only to amounts paid for with self-employment earnings. The housing deductions does not reduce self-employment Tax. Also, if you have taken the foreign housing exclusion, you cannot also take a home office deduction. That would be double dipping in the eyes of the IRS.

The housing cost amount deduction can be claimed only to the extent that foreign earned income is greater than the sum of the earned income exclusion and the housing cost amount exclusion for any taxable year. If the deductible housing cost amount cannot be used because of limitation, the unused amount can be carried forward to the following year, which cannot be done for an employee.

How and where is it reported?

Exclusion is reported on Form 2555, Part VI. This exclusion is an addition to the Foreign Earned Income Exclusion and reported on Schedule 1 as other Income (Negative) which goes to Form 1040, Line 8.

conclusion

Foreign Housing exclusion, which is a Tax benefit to Overseas expats in addition to the Foreign Income Exclusion should not be overlooked. If you had qualified housing expenses which you incurred on your Overseas Apartment, you should complete Form 2555 to claim this exclusion. Your Tax Home must be abroad and qualify for the FEIE under BFR & PPT tests for the current year.

Got Questions ? Connect with us here