US TAX - BLOG

WHAT IS FBAR? (fOREIGN BANK ACCOUNT REPORT)

OR FINCEN FORM 114?

TABLE OF CONTENTS

- Introduction

- Who should be filing FBAR (Foreign Bank Account Report) ?

- Do Green Card Holders or Foreign Nationals who elect to file a Full Year Tax Return file FBAR?

- Which Foreign Financial Accounts need to be reported ?

- When is the due date for filing FBAR ?

- What are the FBAR penalties for NON-Compliance ? Can you file a Delinquent FBAR?

- Conclusion

Introduction

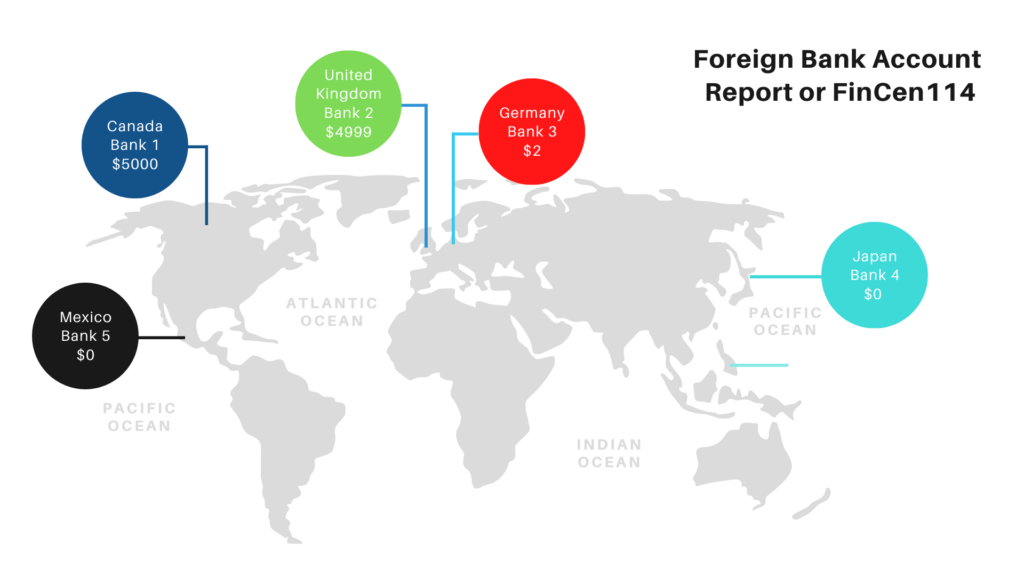

The term “FBAR” stands for Foreign Bank Account Report also known as FinCen Form 114. A US Person (Citizen/Green Card/Resident) who has ownership or control (signature authority) over Foreign financial accounts like bank accounts, retirement/pension, brokerage accounts & mutual funds over $10,000 at any time during the Tax year, even for a second, has to file FBAR with the treasury department. Apart from the Foreign bank account report, you may have a Filing requirement for Form 8938. Click here to know the differences between these two forms.

Who should be filing FBAR (Foreign Bank account report) or FinCEN Form 114 ?

A United States person, including

- a citizen,

- resident,

- corporation/partnership/limited liability company/trust and estate

Let’s assume you are a US expat moving to France, your US employer is now paying your salary in a foreign bank account, which you later move back to a US bank account. Now, if that salary is less than 10k at any point, no need to file FBAR. However, if that income from salary in the foreign bank crosses $10k or more, you will have to File FBAR. Similarly, if you have multiple foreign bank accounts and say you had $9,999 in one bank, $10 in the second foreign bank account, you have to file FBAR.

Remember! The $10,000 is the aggregate threshold for all your Foreign Financial Interests, not just individual bank accounts.

Also when converting between a foreign currency and United States dollars, use the Treasury Reporting Rates of Exchange for the last day of the calendar year. If no Treasury financial management service rate is available, use another verifiable exchange rate and provide the source of that rate.

DO GREEN CARD HOLDERS OR FOREIGN NATIONALS WHO ELECT TO FILE FULL YEAR HAVE TO FILE FBAR ?

Every year hundreds & thousands of residents & non-residents receive Green Cards from the United States Citizenship and Immigration Services. Many of them have foreign bank accounts in their home country and unfortunately not all of them are aware of the FBAR rules or the FATCA Form 8938 reporting requirements. Sadly, they might end up paying huge penalties for not reporting or not being compliant with the US tax laws. Similarly, Foreign Nationals who have a temporary work permit (L1/L2/H1) also may not be aware of reporting their foreign financial accounts. Most taxpayers are under the impression that they only need to report income from the United States. That’s incorrect! The United States taxes its citizens & Residents on World-Wide Income. The same Tax Rules would apply to Foreign Nationals who are residents and Green card holders.

Example: John is a citizen of China. He has been physically present in the United States every day for the last three years. Because Matt is considered a resident by application of the rules under 26 U.S.C.§ 7701(b), he is required to file an FBAR.

Example: Jennifer is a permanent legal resident of the United States. Jennifer is a citizen of the United Kingdom. Under a tax treaty, Jennifer is a tax resident of the United Kingdom and elects to be taxed as a resident of the United Kingdom. Jennifer is required to file an FBAR. Tax treaties with the United States do not affect FBAR filing obligations.

Which Foreign Financial ACCOUNTS NEED TO BE REPORTED?

- Foreign Bank

- Foreign Securities

- Debt Instruments

- Insurance policy with cash surrender value

- Mutual Funds

- Signature Authority over Foreign Accounts (If you are the CEO/CFO) on behalf of the Company.

How are Joint FBAR Accounts reported?

If two persons jointly maintain a foreign financial account, or if several persons each own a partial interest in an account, then each United States person has a financial interest in that account and each person must report the entire value of the account on an FBAR.

Joint filing by Spouse: The eligible spouse of an individual who needs to file FBAR is not required to file a separate FBAR if the following conditions are met: (1) all the financial accounts that the non-filing spouse is required to report are jointly owned with the filing spouse; (2) the filing spouse reports the jointly owned accounts on a timely filed FBAR electronically signed (PIN) in item 44; and (3) the filers have completed and signed Form 114a, Record of Authorization to Electronically File FBARs (maintained with the filer’s records).

If not then, both spouses are required to file separate FBARs and each spouse must report the entire value of the jointly owned accounts.

When is the due date for filing FBAR (Foreign Bank Account REport) ?

The due date to file FBAR, which is an annual report, is the same as your US Tax Filing due date of April 15th of the following year. For the 2020 US Tax year, the due date would be April 15, 2020. If you missed this date, it’s automatically extended till October 15, 2021. No separate extension is needed to file FBAR.

How to file your FBAR or FinCen 114?

You can file your FBAR electronically through the financial crimes enforcement network’s website here. Once you visit the website, you are presented with 2 options to file. You can either upload the Pdf with the details of your foreign financial interests or if you have all the information at your disposal, you can complete it online. If you do choose the latter, you would have to complete it in one go, there isn’t an option to save and come back to it later. However, that being said, it’s considered to be a better option compared to uploading your PDF with your e-signature.

If you want to paper-file your FBAR, you must call FinCEN’s Regulatory helpline to request an exemption from e-filing. If FinCEN approves your request, FinCEN will send you the paper FBAR form to complete and mail to the IRS at the address in the form’s instructions.

Once filed, you must keep these records of filing for 5 years from the due date of the FBAR. If you are holding a position of authority and have signature authority over foreign accounts, your employer must keep the records of these accounts.

Penalties for Non-Compliance

Being non-compliant with FBAR, you will be subjected to civil monetary penalties and/or criminal penalties. The amount of penalties would depend upon the individual’s situation and circumstances. The current maximum penalty for 2020 for Non-wilful violation of transaction is $12,921.

Can you file a delinquent FBAR?

As per the IRS website, Filing an FBAR late or not at all is a violation and may subject you to penalties. If you have not been contacted by the IRS about a late FBAR and are not under civil or criminal investigation by the IRS, you may file late FBARs and, to keep potential penalties to a minimum, should do so as soon as possible. To keep potential penalties to a minimum, must file ASAP. You could use the delinquent FBAR submission procedures or the streamlined filing compliance procedures to stay current with your FBAR compliance.

Conclusion

The Fatca Act was passed in 2010, to prevent tax evasion & money laundering of wealthy Americans overseas. This act makes sure that the Financial institutions abroad report back to the IRS about the Financial interests of Americans overseas. Today, try opening a bank account anywhere in the world, you will be confronted with this common question, are you an American Citizen or a Green Card Holder? Every bank out there has to Comply with the FATCA rules. Uncle Sam is clearly driven by greed and flexing his financial might to the rest of the world. The penalties are severe for non-compliance, way beyond the Tax Preparation fees charged by Qualified Accountants. If you are unsure, it’s imperative that you consult a US Tax Expert or get in touch with us regarding the filing of FBAR. This just isn’t worth the headache. Or is it?