WhAT IS FORM W-8BEN?

TABLE OF CONTENTS:

What is Form W-8BEN?

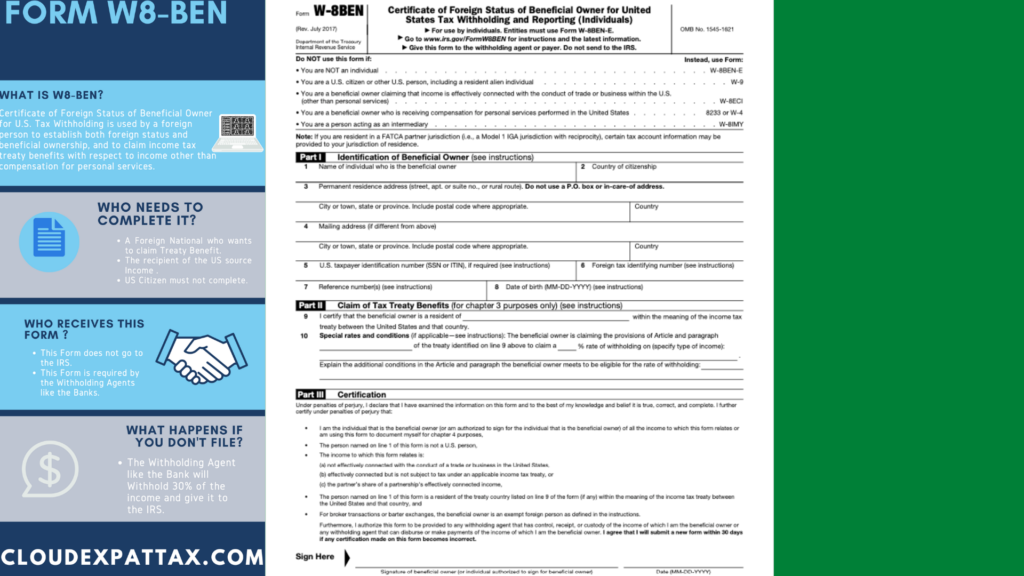

Form W8-Ben is a Certificate of foreign status of Beneficial Owner for U.S. tax withholding is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services.

Foreign persons are subjected to 30% Tax in the US, if they receive Income from US sources that consist of:

- Dividends

- Interest

- Rents

- Royalties

- Annuities/Premium

- Compensation for Services performed

- Other fixed or determinable annual or periodical gains, profit or Income.

The taxes are imposed on the gross amount paid out.The forms are effective for the year in which they are signed and three calendar years afterward. Therefore, a W-8BEN signed on June 1, 2021, would be valid through June 1, 2024. US Citizens must not use this Form.

What is the purpose of FORM W-8BEN?

Form W-8 Ben is needed to State that:

- You are not a US person

- To claim that you are the beneficial owner of the Income for which Form W-8BEN was provided.

- Get the most important benefit through a tax treaty, to claim reduced rate of, exemption from, withholding as a resident of a foreign country which the US has an income Tax treaty.

Why should a Foreign National fill Form W-8BEN?

Failure to submit a Form W-8BEN could result in paying either the full 30% rate or the backup withholding rate. The Foreign person must hand over this Form with all its details to the withholding agent. Students studying in the United States or even a Youtuber outside of the United States must fill this form (Channels views from Americans). This form does not go to the IRS, instead it goes to the US Financial Institutions who are FATCA Compliant. This Form is needed by the Payor and it’s their responsibility to make sure these Forms are completed properly. You can find the instructions here.

What is a difference between Form W-8BEN AND Form W-8BEN-E?

Foreign business entities should file Form W8-BEN-E (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting) instead of W-8BEN, which is for individuals only. Foreign businesses are also subject to the same tax rate (30%) that foreign individuals are subject to, and like individuals, they too may qualify for a reduced tax rate if their home country has a tax treaty with the U.S.

How to complete form W-8BEN?

Once you have downloaded the Form W8-Ben from the IRS website, you can follow the below instructions to complete this Form.

- Line 1: Enter your name.

- Line 2: Enter your citizenship. If you’re not a resident of the country where you have citizenship, you should enter your country of residence (instead of your country of citizenship).

- Line 3: Enter your Permanent address. For the purposes of W-8BEN, this is your tax home, which is where you reside for income tax purposes (Enter Permanent Address)

- Line 4: Enter your mailing address (if different from Line 3)

- Line 5: Enter your U.S. taxpayer identification number. This should be either a Social Security Number (SSN) or an individual taxpayer identification number (ITIN). If you don’t have either, you can skip to line 6.

- Line 6: Enter your foreign tax identifying number if you don’t have an SSN or ITIN.

- Line 7: Reference Number

- Line 8: Enter your date of Birth (Make sure its in MM-DD-YYYY Format).

- Line 9: Enter the foreign country under whose tax laws you claim tax benefits. This of course needs to be one of the countries with which the U.S. has a tax treaty.

- Line 10: Foreign individuals who are students and researchers should enter specific withholding rates. Other persons may need to complete this line if they claim benefits that require them to meet conditions not addressed on W-8BEN. Also mention the type of income – commissions, royalties etc.

- Part III: Here, you’ll need to certify with your signature under penalties of perjury that everything on the form is true and correct.

Final WORDS

There are several types of Form W-8. Form W-8BEN is just one of the 5 Forms out there. As a Foreign national, instead of going through the headache of filing a US Tax Return, Form 1040-NR to claim back any possible refund through incorrect withholding, why not fill your form W8-Ben correctly in the first place?

Got questions? Let us know here.